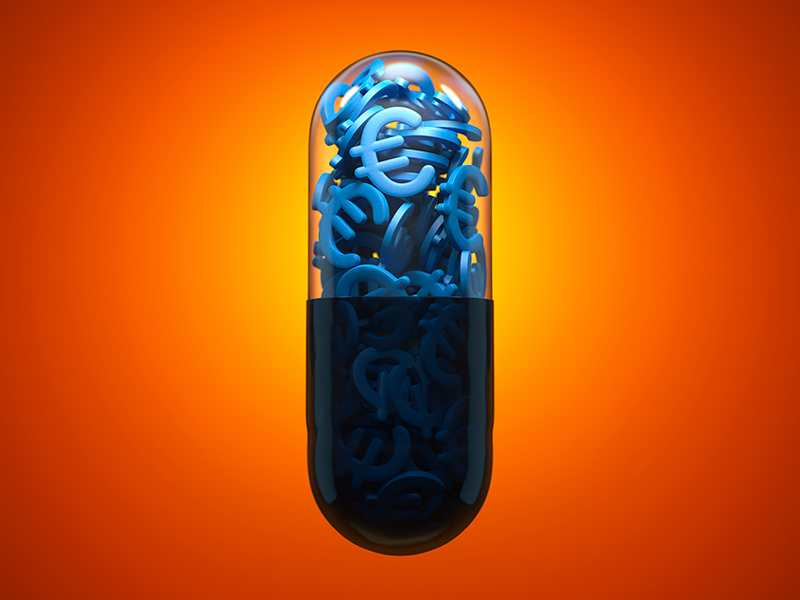

Alphabet throws weight behind $300m European biotech fund

Deepening its investments in healthcare, Google’s parent company has joined the backers of the Medicxi-run fund

Google’s parent company Alphabet is the latest firm to join a new $300m fund dedicated to investment in Europe’s biotechnology companies, demonstrating confidence in the potential of European healthcare innovation. The fund, run by life sciences investment firm Medicxi is also backed by the European Investment Fund and Swiss pharmaceutical giant Novartis.

Alphabet has several dedicated life science investment arms across the globe, which aim to maximise long term financial gains by taking bets on cutting edge medical research with the potential for mass adoption. Since people are living longer, end of life care is a field of growing interest for tech firms seeking investment opportunities with a long-term pay off. Diagnosis rates of diseases such as diabetes and dementia have ballooned in the last decade and an effective treatment would deliver huge financial benefits to investors.

Since people are living longer, end of life care is a field of growing interest for tech firms seeking investment opportunities with a long-term pay off

The Medicxi fund will focus specifically on products that have already reached Phase II clinical development, providing capital to expand the company at this stage. Focusing on products at this relatively advanced stage of development reduces the chance of blowing investment on treatments that seem promising but never make it to market.

Explaining the motivation for the fund, Medicxi co-founder Francesco De Rubertis said, “there is a funding gap because there is a maturing class of biotechnology companies now in Europe,” in a statement to Reuters.

Verily, the Alphabet subsidiary behind the investment in Medicxi’s fund, has also invested in GlaxoSmithKline, Novartis and Johnson & Johnson. Verily has funnelled money into the research departments of these companies, providing capital for the exploration of medical applications of technology such as robotics in surgery, and also diabetes management. Verily has hired investors with a lot of experience in drug research, such as Robert Califf, former head of the US Food and Drug Administration.

Other Alphabet outposts have specific fields of research for investment; Calico invests in companies whose primary research is in products that may decelerate the ageing process, and GV focuses on start-ups in the US. This strategy of breaking healthcare investment into divisions focussing on one field of research is designed to ensure investor expertise is not spread too thin; investors have a lot of knowledge about the research they will fund and are able to dig deeper into the science behind treatments, to make a much more educated guess about what will potentially work.