Offshore drilling booms as companies explore new frontiers

The biggest beasts of the sea are not whales or giant sharks but massive, sky-scraping drilling rigs that can reach the deepest parts of our oceans. Offshore drilling is booming and competition keeps players on top of their game

Maersk Intrepid next to one of its three sister rigs. Maersk has unveiled two new ultra deepwater drillships in the last year as the offshore-rig-construction sector grows strongly with oil majors moving to new, harsher frontiers

As the demand for resources continues to boom, the hunt for new oil and gas fields has intensified. Despite the drilling industry suffering due to recent economic contraction, demand for advanced drilling capabilities is still high and industry budgets are still going strong. With oil and gas harder to find, and national conglomerates monopolising the easily accessible oil fields, drilling has become harder and more specialised. Rigs need to go deeper, challenge higher pressures and drill in harsher environments than ever before.

Just four years after offshore drilling was brought to a near-standstill in many parts of the world following BP’s Gulf of Mexico Macondo well blowout, the offshore-rig-construction sector is growing strongly, with oil majors moving to new, harsher frontiers while also having to meet tighter safety requirements.

Speculative drilling firms use technology that is at least 20 years old – Maersk Drilling’s Chief Technical Officer, Frederik Smidth

Sustained high oil prices have made exploration and production in areas such as offshore Africa and the North Sea viable, even though the climate in these areas – particularly the latter – is rough to say the least. This puts new demands on rig specifications, which need to be able to withstand extremely low or high temperatures, gale force winds and rough seas. This is a fresh demand on the immense technology that already ensures drilling companies can go deeper than any other firm has gone before, while maintaining some of the strictest security requirements out there.

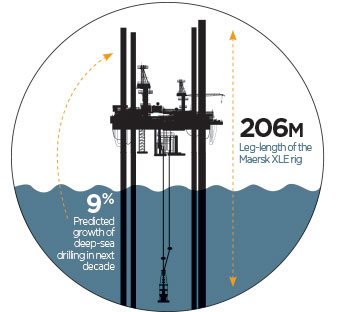

Spending on wells has gone up significantly in recent years and, in 2012, reached $43bn, returning global drilling activity to pre-Macondo highs. Deepwater drilling in particular is poised for growth, with spending reaching $114bn by 2022 according to analysis by Wood Mackenzie. The projections suggest deepwater growth at an overall annual rate of nine percent for the next decade. The study also noted that deepwater drillers have discovered 41 percent of volumes and created $351bn in value over the last decade, eclipsing the performance of onshore and shelf. This, again, has led to significant growth in the deepwater sector, especially in the Arctic region, where licences increased by 39 percent in 2012 alone.

New specifications

However, meeting the demand for deep drilling in a harsh environment requires billions of dollars of investment, careful planning, and tens of thousands of additional workers to make it feasible. In particular, speciality, high-class rigs have come into demand. Only a few firms are able to fulfil the strict requirements in the North Sea and Arctic region, as well as provide the capability to drill at unprecedented depths.

The first firm allowed to drill in the US off-shore oil fields after the Macondo accident was Maersk Drilling, whose rigs already exceeded the new, strict safety regulation in the region. Maersk Drilling has never been the biggest player in the field, but has, in recent years, established itself as one of the key firms to watch. Having recently launched the world’s biggest jack-up, and currently working on a project that will see it take on wells with a higher pressure than ever before, Maersk Drilling has become known for its innovation and high standards. The firm has been in an intense expansion phase for the past three years, aiming to double its size by 2015.

“We’ve expanded our capability in ultra deepwater and ability to operate in the North Sea,” says Maersk Drilling’s Chief Technical Officer, Frederik Smidth. “This included a dramatic upgrade of our rigs, doing a 2010 model of our 15-year-old jack-ups, and improving safety and the work environment. We’ve had a particular focus on efficient drilling. So our rigs are stronger, bigger and more efficient. This comes down to a real automation of the drilling process that ensures there’s no need for human interference for a longer period of time than before. The rigs have the top-speed of a really well-trained crew, but the difference with real automation is that we can operate at that capability several times in a day.”

The uptime and drilling efficiency of the firm’s new rigs has been maximised through dual pipe handling, which ensures that, while one drill string is working in the well bore, a second can be assembled or disassembled, reducing the non-productive time. The rig’s automated drill floor features Multi Machine Control; a fully remote-operated pipe handling system that allows all standard operations to be conducted without personnel present and with improved efficiency.

Such rig specifications have changed dramatically in recent years as the industry has become increasingly competitive, and more and more players are looking to find a niche in the market where they can be the top-supplier. In particular, specialist firms such as Maersk Drilling have increased their focus on the equipment side of things.

“We have focused on creating full operating systems rather than specific tools,” says Smidth. “Speculative drilling firms use technology that is at least 20 years old and which focuses on the tools rather than an overall system. This makes them more dependent on the crew, and it’s less efficient and less safe.”

Strict regulation

A particular hurdle for rigs is living up to regulations in certain complicated oil fields. The North Sea oil fields are primarily under Norwegian regulation, which is among the strictest in the world. In general, drilling regulation has been tightened significantly as a reaction to the Macondo incident.

“With growing concern about environmental protection, rules and regulations for well drilling are harder and stricter,” says Indeok Kim, Marketing Manager for Samsung Heavy Industries’ drilling facility (a key rig-builder). “The outbreak of several severe oil spills has also made safety regulations more stringent. So it is inevitable to reinforce rigs’ fuel control and well-pressure maintenance capability. For instance, issues with BOPs (blowout preventers) have been highlighted in the aftermath of the Macondo accident, and they are inducing operators to require BOPs with higher technical specifications. By default, drillships need to be technically more evolved in order to be compatible with BOP requirements.”

The UK, which controls some of the oil fields in the North Sea, significantly beefed up its environmental inspections of oil rigs in the wake of the Gulf of Mexico disaster, doubling inspection staff numbers and the number of annual inspections. For the 24 drilling rigs stationed in the UK’s part of the North Sea, this meant focusing attention on safety and environmental performance, particularly for deepwater drilling rigs, which typically explore for oil in technically challenging areas where little is known about the geology. Such drilling has grown in popularity, with the UK Government agreeing to offer millions of pounds’ worth of tax breaks to oil companies seeking to develop the deep waters off the west coast of the Shetland Isles.

Norwegian regulation goes so far as to stipulate that oil and drilling rigs maintain special ‘acoustic switches’ that shut down operations completely and remotely in the case of a blowout or explosion. The Norwegian oil business has earned a strong international reputation for industrial efficiency, and environmentally benign exploration and production technology. Its regulations also insist on low CO2 emissions, in line with Norway’s policy to achieve carbon neutrality by 2030, and ensure rigs operating in the area are the most fuel-efficient in the world. This hasn’t meant less business for Norway – the world’s sixth largest oil producer – rather it’s resulted in companies working harder to gain access to the lucrative ‘elephant fields’ in the cold North.

“The North Sea is a very mature area, so we know it well,” says Smidth. “But the environment is very harsh – it’s cold, with strong winds and higher waves than anywhere else. This means that our equipment needs to be bigger and better just to stand and drill in that climate.”

Rig demand

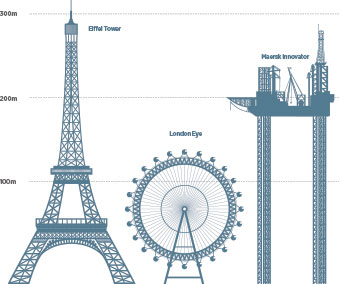

In the past year alone, Maersk Drilling has unveiled two new ultra deepwater drillships and two new XLE jack-ups specialised in drilling in ultra harsh environments. In total, the firm will be building four XLE rigs before 2016, representing a total investment of $2.6bn. These oceanic titans will have a leg length of 206.8m, making them the largest jack-ups in the world, reaching water depths of up to 150m. Notably, all rigs have been built subject to an order from a leading oil company, as demand for specialised rigs continues to soar. The first three jack-up rigs are being supplied by the Keppel FELS shipyard in 2014-15, and the fourth will be delivered from the Daewoo Shipbuilding and Marine Engineering shipyard in South Korea in 2016.

The latest rig to be unveiled was the XLE-2, which was transferred from the Keppel FELS shipyard in Singapore to the Norwegian North Sea in August, where it will commence a five-year contract with Det Norske Oljeselskap. The rig will be working on the Ivar Aasen field, which contains approximately 150 million barrels of oil equivalents, bringing the total estimated contract value to approximately $700m. Maersk’s investments will be quickly paid off by the queue of oil companies wanting to order multi-million dollar specialised rigs.

The natural decline of oil production and rise of Enhanced Oil Recovery will lead rig demand – Indeok Kim, Samsung Heavy Industries

Exploration, appraisal and development wells are set to increase by 150 percent, from 500 wells per year in 2012 to 1,250 by 2022. To meet this demand, an additional 95 deepwater rigs will have to be constructed between 2016 and 2022 at a cost of $65bn, according to a Wood Mackenzie report.

“From 2012 to 2013, contracts for mobile offshore drilling units (excluding jack-up rigs) have reached the highest annual level ever, with 91 units on order in total,” says Kim. “Oil companies have increased the amount of capital expenditure to cover up the shortage of oil production on a global scale.” He also points out that, with the increase in ultra deepwater drilling, drillship and semi-submersible rigs have been particularly popular.

Going further

For major rig-builders Keppel Corporation and SembCorp Marine, this year has been particularly profitable. Keppel has won contracts worth $661m from Grupo R (a Mexican drilling company) to build four jack-up rigs that will be used by Pemex (Mexico’s state-owned energy company) to develop a series of prospects along the country’s coast. Pemex, the world’s seventh-biggest oil producer, is planning to invest $25bn this year alone. Similarly, Sembcorp’s sales last year rose 11.8 percent to $4.43bn.

Together, the two Singaporean companies account for about 70 percent of the market for

production of jack-up rigs, and dominate the market for semi-submersibles, which float in ultradeep water.

Smidth maintains the expertise offered by Asia’s shipyards is hard to find anywhere else, and that a strategy to become the world’s leading high-end supplier of drilling rigs means Maersk Drilling will continue to innovate. This has prompted its highly publicised partnership with BP to develop engineering designs for a new breed of advanced, deepwater, drilling rigs. The ‘20K Rigs’ will be able to operate in high-pressure and high-temperature reservoirs up to 20,000 pounds per square inch and 176°C. If the companies succeed, it will be an unprecedented drilling feat.

Competition has also started to emerge among shipyards after Daewoo Shipbuilding & Marine Engineering said earlier this year that it planned to re-enter the jack-up rig-building market for the first time since 1983. Korean and Singaporean shipyards have generally dominated the rig-building market, owing to their specialising in deepwater and jack-up rigs. However, Chinese shipyards Shanghai Waigaoqiao and China Rongsheng Heavy Industries have also secured orders this year for at least three jack-up rigs. For Samsung Heavy Industries, this has prompted a growing focus on niche markets.

“In order to penetrate niche markets such as the Arctic region, Stena and SHI have cooperated with each other to develop an Arctic drillship that can endure harsh cold temperatures,” says Kim. “The demand in the North Sea will be fundamentally high for some time. The natural decline of oil production and rise of Enhanced Oil Recovery will lead rig demand in the region and the need for replacing aged rigs in the area is expected to sustain the demand.”

The drilling industry is poised for another banner year, albeit one of increased competition and with a growing focus on innovation that can accommodate the need for safety when drilling deeper and more dangerously than ever before. Environmental concerns have never been so great, and, in order for drilling firms and rig-builders to maintain their advantage, it will all come down to specialisation, safety and efficiency for the beasts of the sea.