Neo Lithium posts positive PFS results for its 3Q Project in Argentina

Toronto-based Neo Lithium is making good progress with its lithium exploration project in Argentina, according to a pre-feasibility study released by the company on March 21

Neo Lithium's 3Q Project in Argentina has now advanced to a stage where a preferred processing method has been established and an effective method of mineral processing has been determined

Neo Lithium, a growing name in the lithium brine market, has unveiled impressive results for its pre-feasibility study (PFS) into an exploration project in Argentina. The work, known as the 3Q Project, was carried out in the Catamarca Province, the largest lithium producing area in the country.

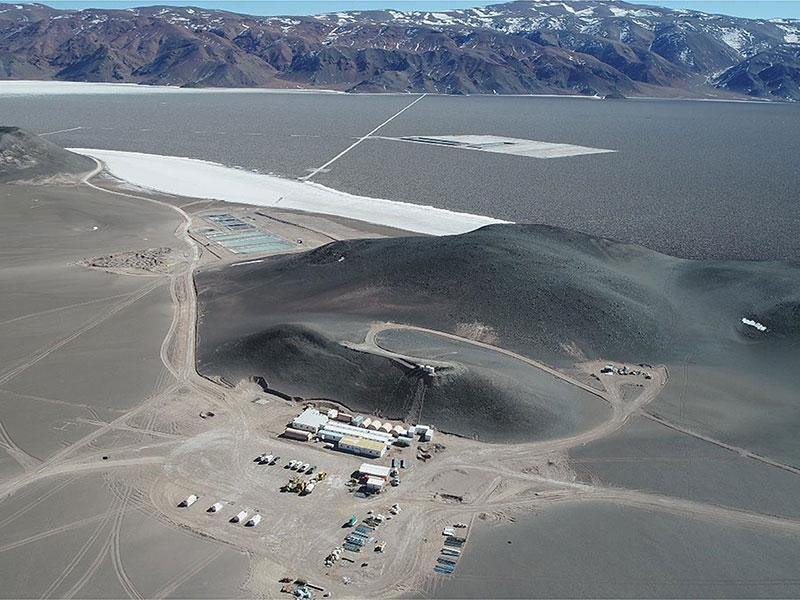

In recent months, Neo Lithium has rapidly advanced its 3Q Project, a unique high-grade lithium brine lake and salar complex located in what is known as Latin America’s ‘lithium triangle’. The project’s technical team characterises this unique salar complex as one of the largest lithium brine resources in the world.

“With the discovery of a high-grade core, we optimised the 3Q Project development plan with respect to our preliminary economic assessment,” said Waldo Perez, President and CEO of Neo Lithium. “The new [capital expenditures] and [operating expenses], together with the long life of [the] mine and high-grade brine, allow us to present a superior [internal rate of return] of 50 percent.

“Furthermore, we are currently continuing to drill the high-grade core and we are now able to validate that the 3Q Project still has further significant high-grade resource upside potential.”

The PFS represents a comprehensive study of the technical and economic viability of the 3Q Project. It has now advanced to a stage where a preferred processing method has been established and an effective method of mineral processing has been determined.

Project highlights

“We are delighted with the results of the PFS,” said Carlos Vicens, CFO of Neo Lithium. “We have improved the [post economic assessment] results on all fronts, requiring a smaller capital investment for a similar net present value. The 3Q Project is now easier to build, easier to finance, and its larger size allows us to think in terms of potential phased expansions. The final value of this project will be realised over time.”

The strategy to maximise the value of the 3Q Project was achieved by first extracting the high-grade core brine via five wells strategically located in the middle of the high-grade component of the measured and indicated resource. Early extraction of high-grade brine allows minimal sizing of early stage ponds. The grade, meanwhile, is expected to decrease over time, as progressively lower grade brine is extracted. Consequently, the total pond area is set to increase in the coming years.

In recent months, Neo Lithium has rapidly advanced its 3Q Project, a unique high-grade lithium brine lake and salar complex located in Argentina

A numerical groundwater model was developed to support the reserve estimate and the development of Neo Lithium’s 35-year mining plan. The model predicts the brine grade will decrease over time, and simulates additional brine recovery to maintain production at around 20,000 tonnes of lithium carbonate equivalent (LCE) over the lifetime of the mine. The model also projects long-term brine recovery, based on the rigorous assembly of groundwater flow and solute transport parameters.

In the initial 10 years of the plan, five wells will each produce high-grade brine at a rate of 51 litres per second (l/s). During the following 10 years, the same wells will produce 64l/s. From 20 years onwards, a total of 11 wells will be in operation, with individual production rates between 23 and 49l/s. These variable brine recovery rates are designed to maintain a relatively constant production rate of approximately 20,000 tonnes of LCE.

The required yields are reasonable within the known parameters of the brine aquifer. However, ample space exists for additional production wells, if required. The company has already installed one production well capable of a sustained production of 84l/s from the high-grade zone.

Proposed operation and processing

The PFS identifies the preferred development option as being a conventional evaporation pond operation, followed by the purification and precipitation of lithium carbonate.

“We have been working towards a mining plan and a process facility that maximises the competitive advantages of the 3Q Project, which is [of a] high grade, with low impurities and a large size of resource,” said Gabriel Pindar, Director and COO of Neo Lithium. “The PFS has been tailor made to the 3Q Project, [and uses] proven technologies that have been utilised by major companies in the region to minimise operational and construction risks.”

The process begins by extracting brine from the pumping wells and transferring it into solar evaporation pre-concentration ponds. After a period of around 120 days, approximately 90 percent of the sodium chloride and other salts will have crystallised from the brine. The potash is harvested in a subsequent pond, with no requirement for reagents. Later, the brine is transferred to calcium chloride precipitation ponds and thickeners are used to extract most of the calcium, which precipitates as antarcticite.

Minor amounts of hydrochloric acid are then required for pH control, as well as to crystallise boric acid out of the brine. Residence time in the calcium chloride ponds is approximately 105 days. When the brine achieves a lithium concentration of 3.5 percent, it is transported to the brine processing plant. The total time taken to get to this stage is approximately 225 days, while the rate of lithium recovery in the ponds is approximately 60 percent.

With the pre-feasibility study defining the major economic parameters of the 3Q Project, Neo Lithium now has a strong foundation to discuss various financial options to move the project forward

The influent lithium brine grade is predicted to change over the lifespan of the mine, shrinking from 1,177 milligram litres in year one to 670 milligram litres in year 35. Consequently, pre-concentration ponds must be expanded over time to keep production constant. In the initial phase, 406 hectares of pre-concentration ponds will be utilised. This will be followed by two expansions of 102 hectares in year 10 and year 20. Fortunately, calcium chloride ponds and thickeners remain constant throughout. The average production of LCE has been estimated at 20,000 tonnes per year, but the need for capital at the beginning of the project is minimised by mining the high-grade material first.

Processing the concentrated brine is achieved through four stages, which take place at plants in Fiambalá and Recreo. In Fiambalá, solvent extraction is used to remove the remaining boron. Sulphatation, which removes the remaining calcium by adding a saturated solution of sodium sulphate, follows shortly after. In Recreo, the solvent extraction is then mixed with mother liquor and minor soda ash in order to remove traces of calcium and magnesium. The addition of soda ash and heat to precipitate the lithium carbonate also takes place in Recreo, followed by drying and packaging.

Recovery in the sulphatation plant is 92 percent, while recovery in the carbonation plant is 85 percent. The company is now operating a 1:500 scale pilot plant in Fiambalá to fine-tune this standard method. The general approach has proven effective when attaining battery-grade lithium carbonate in the past.

Initial capital costs are estimated at approximately $319m. The life-of-mine deferred and sustaining capital costs are estimated at approximately $207m, while closure costs are estimated at $26m.

Future developments

Neo Lithium intends to complete a full feasibility study to further validate and detail the elements outlined in the PFS. At reserve level, it has recommended to extend drilling to a depth below the already drilled 100 metres. The definition of additional high-grade resources could have a significant impact on pond requirements, presenting the possibility of increasing production with fewer ponds. This programme is already underway and the first drilling results are expected soon.

Additional long-term pumping tests in the high-grade zone are also recommended to test the aquifer in production scale pumping scenarios. Currently, the company is carrying out a 20-day pumping test that is almost complete. The pilot plant operation, which is currently in the commissioning and testing phase, is critical to completing the feasibility study and proof of concept relating to the plant’s ability to yield battery-grade lithium carbonate. Further, the final feasibility study must consider the economics of by-products including potash, calcium chloride and boric acid, which are all readily available with minor additional investment. The recommended feasibility study is expected to be completed in the first half of 2020.

With the PFS defining the major economic parameters of the 3Q Project, the company now has a strong foundation to discuss various financial options to move the project forward. “The robust project economics generated from the PFS further validates our view that the 3Q Project is an exceptional project, particularly when our industry faces unprecedented growth and it needs predictable, long-term, low-cost producers,” said Constantine Karayannopoulos, Chairman of Neo Lithium. “We are not short of options, and the next step is a careful analysis of how to maximise value for our shareholders.”