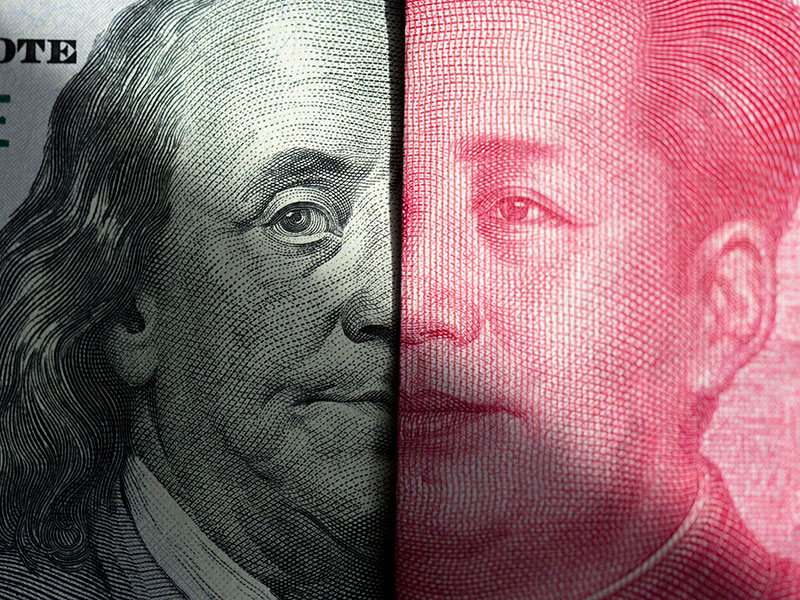

Qualcomm’s NXP takeover fails as US-China trade tensions extend to M&A market

Chinese regulators have refused to approve Qualcomm’s proposed $44bn acquisition of rival firm NXP in a move some have attributed to the escalating trade war between the US and China

Although many expected Qualcomm's NXP bid to be approved by Chinese regulators, the increasing likelihood of an all-out trade war with the US appears to have prompted a change of heart

Trade tensions between the US and China have claimed another casualty. President Donald Trump has already been forced to set aside $12bn in aid for the US farmers that will be negatively affected by retaliatory tariffs, while bankruptcies are being predicted for many Chinese companies. Now, a proposed $44bn takeover bid by American chipmaker Qualcomm has fallen by the wayside after the company’s planned acquisition of Dutch semiconductor firm NXP did not receive approval from regulators in Beijing.

The takeover had been in the works since 2016 and eight other regulators from around the world approved the bid months ago. Chinese regulatory approval was also expected, particularly as Qualcomm and NXP have little overlap in terms of the two companies’ product portfolios. However, the increasing likelihood of an all-out trade war appears to have caused Chinese regulators to have a change of heart.

Qualcomm’s failed NXP bid comes as a major blow to the M&A landscape, as there will now be concerns that China could block other planned acquisitions

By withholding approval beyond the agreed takeover deadline, Beijing effectively killed the deal. Qualcomm officials confirmed as much in a statement issued early on July 25.

“We intend to terminate our purchase agreement to acquire NXP when the agreement expires at the end of the day today, pending any new material developments,” explained Qualcomm CEO Steve Mollenkopf. “In addition, as previously indicated, upon termination of the agreement we intend to pursue a stock repurchase programme of up to $30bn to deliver significant value to our stockholders.”

The failed takeover comes as a setback to both companies – Qualcomm will have to pay a $2bn break-up fee to NXP, while the Dutch firm will now have to convince investors it has a long-term future – but could also have wider ramifications. It will certainly come as a major blow to the M&A landscape, as there will now be concerns that China could block other planned acquisitions.

The refusal to approve Qualcomm’s NXP bid also further damages US-China relations. Trump has recently threatened to impose new tariffs on the US’ trading partners, but as China imports relatively few products from the US, it gives the country limited ability to respond in kind. Perhaps scuppering business mergers and other investment opportunities will provide China with another way of retaliating.