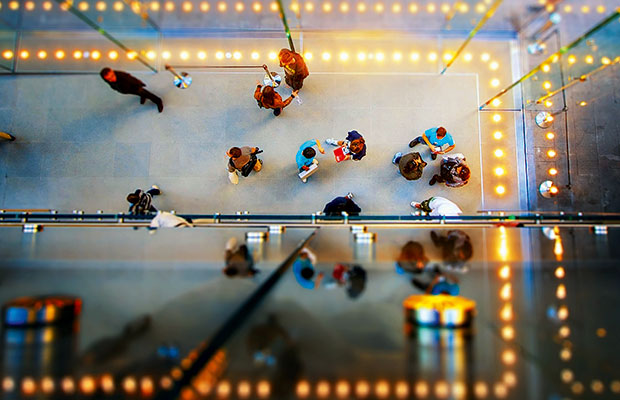

Retail industry uses in-store analytics to spy on shoppers

In-store analytics are beginning to gain traction in traditional retail, and could help manage the decline in bricks-and-mortar sales

Retail stores are increasingly turning to data analytics to provide the best in-store experiences to shoppers. It is hoped the practice could halt the decline in visits to physical stores as e-commerce continues to thrive

Walk into any high street store of your choosing, but be warned: you are being watched.

As consumers have grown increasingly choosy about how they spend their time and money, retailers can ill afford to offer a shopping experience short of ideal. Bricks-and-mortar retailers have for years been tweaking and re-tweaking their shop layouts in a bid to better understand, attract and retain customers. Although the process has not halted the high street slide at a time when e-commerce has been gaining (up 16.9 percent in the US last year alone), the emergence of in-store analytics has relieved the pressure somewhat.

ShopperTrak statistics show US retail foot traffic in the 2013-14 Winter holidays was near enough half of what it was three years ago, and, across the globe, high streets are finding themselves populated by shuttered up shop fronts and empty properties. Nevertheless, bricks-and-mortar sales still account for the vast majority of the retail market, and will continue to do so for years to come, leaving those struggling in the field with a very clear missed opportunity.

Consumers don’t think in terms of ‘channels’, ‘multichannels’ and ‘omnichannel’. They think in terms of ‘shopping’

In-store analytics

As part of the industry-wide attempt to stop the rot in traditional retail, leading names are taking a leaf out of e-commerce’s book and turning to data analytics as a means of optimising shop floor space and better understanding customer behaviour. “In-store data analytics are certainly a key, if not the key,” says Chitra Balasubramanian, Head of Business Analytics at RetailNext. “Good data informs better decision-making, regardless of the business or the function within it. It allows retailers to better understand shoppers and their behaviours, and with that understanding they are better equipped to make strategic and tactical decisions on everything from store design and layout to merchandising and displays, from marketing programmes to attract shoppers, to staffing allocation to better serve them.”

Whereas online retailers have been able to access complex – sometimes bafflingly so – statistics about customer behaviours since the mid-1990s, this advantage has not been so easily afforded to those in physical retail. Analytics capabilities have progressed to such an extent that it has become routine for shoppers to be faced with recommendations, related items and expert product walkthroughs when browsing online. In bricks-and-mortar retail, however, these same conclusions about individual shoppers’ wants are not so easily drawn, and many retailers have settled instead for simple in-store observations of what works and what doesn’t when attempting to optimise performance.

“Observing shoppers and garnering a better understanding of them has been around since the first merchant opened a store,” says Balasubramanian. “The problem was the observation process – literally watching shoppers in the store – was a very time-intensive, manual process, and conclusions often fell prey to anecdotal evidence and observational bias. About the only real, objective, quantifiable data retailers had was point-of-sale data, and the biggest challenge in that was that it told the end result, but none of the story of what happened getting to that result.”

This basic approach looks set to change; 71 percent of respondents surveyed by Brickstream, as part of a study entitled Retail Analytics: What’s in Store?, said they planned to bring people-counting technology in-store in the next year. In addition, 68 percent of that same sample claimed they were looking to introduce in-store Wi-Fi and loyalty systems by 2015.

In-store analytics are far from restricted to such simple processes, however, and extend to all manner of complex capabilities. For example, the latest advances allow the retailer industry to differentiate between male and female shoppers, identify and track employees, map preferred customer routes, and even look at what they’re browsing online while in-store.

“Technology advances now empower retailers to gather data from a wide array of data streams automatically, and relatively inexpensive computing power can quickly crunch that data into an aggregate,” says Balasubramanian. “The outputs are specific data insights that tell a more complete story of shoppers’ purchasing journeys, and retailers can use those insights to decide what levers to push and pull to better customer experience and store performance.”

“Technology advances now empower retailers to gather data from a wide array of data streams automatically, and relatively inexpensive computing power can quickly crunch that data into an aggregate,” says Balasubramanian. “The outputs are specific data insights that tell a more complete story of shoppers’ purchasing journeys, and retailers can use those insights to decide what levers to push and pull to better customer experience and store performance.”

How we used to shop

The continued adoption of in-store analytics is part of a much broader trend in the industry, as retailers turn, increasingly, to technology in an effort to reverse the decline in high street sales. “Technology is providing bricks and mortar retailers with innovative ways to seize strategic opportunities,” according to one report by KPMG entitled What’s in Store: How Technology is Transforming the Retail Industry.

Although many commentators have been quick to announce the death of physical stores, leading industry names have found different ways of capitalising on what remains a huge market.

“Bricks-and-mortar, as a whole, will continue to see a flat to moderate decline in traffic, but plenty of opportunities exist for retailers,” says Balasubramanian. “It’s important to remember that well over 90 percent of retail business is transacted in-store. The retailers that cater to their customers’ preferences are the ones that will ascend to the status of ‘retailer of choice’.”

Given e-commerce has grown to the extent it has, it’s unrealistic to assume bricks and mortar sales will regain the heights of years passed, but the introduction of complex in-store analytics may help manage the decline. “Retail is rapidly moving to an integrated shopping experience for consumers,” says Balasubramanian. “In the industry, retailers like to talk about channels, and ‘omnichannel’ is perhaps the biggest buzzword of them all. But consumers don’t think in terms of ‘channels’, ‘multichannels’ and ‘omnichannel’. They think in terms of ‘shopping’. To them, it’s a single, integrated experience. Successful retailers are learning they need to have a presence in both the online and offline worlds, and that the experience in those two arenas are consistent and on brand.”

Looking at the changing nature of bricks-and-mortar retail, the sector is set to optimise the customer experience in much the same way e-commerce has done. Although the prospect of being tracked will unnerve some consumers, there’s no question the technology will play a huge part in improving the bricks and mortar retail experience, and reviving what business has been lost to e-commerce.