A fairy godmother for research and development in biopharmaceuticals

Only five percent of candidate drugs currently make it through the initial R&D phase. With demand for novel biopharmaceuticals growing, Batavia Biosciences is helping organisations improve their development processes

Batavia Biosciences aims to solve bottlenecks in the R&D process and help companies bring more biopharmaceutical products to market, while ensuring they remain affordable

The market for biopharmaceuticals – medicines created using biotechnology – has exploded over the past two decades, with annual sales of recombinant proteins and antibodies standing at around $140bn, and vaccine sales totalling approximately $36bn per annum.

These medicines have a massive impact on human health, providing improved and even life-saving treatments for diseases ranging from cancer, haemophilia and diabetes to infectious diseases.

Examples of blockbuster products – those with annual sales over $1bn – include insulin (a treatment for diabetes that makes $34bn each year), erythropoietin (anaemia; $10bn), Remicade (arthritis; $7bn), Prevnar 13 (diphtheria; $5bn) and Gardasil (cervical cancer; $2bn).

The enormous sales success and societal impact of these medicines help to fuel the R&D of novel products, with $127bn spent each year on the development of new and improved versions of biopharmaceuticals.

Based on the number of novel compounds currently in the pipeline, the US is by far the most active market, with around 4,000, according to Batavia Biosciences’ research. Europe and Japan are the second and third-largest contributors, producing 2,000 and 500 compounds respectively, while the rest of the global market provides a further 3,000 compounds.

Of the $127bn flowing into R&D each year, some $117bn is dedicated to conducting clinical trials, while the remaining $10bn is spent on developing manufacturing processes to ensure products are produced to a consistently high standard.

The cost of progress

The journey from compound discovery to market introduction starts with the R&D phase – in which the initial discovery and product refinement takes place – and is followed by a series of clinical trials.

Phase 1 clinical trials seek to determine the safety and dosage of the candidate drug by testing it on tens of healthy volunteers. Phase 2 trials then test the drug on hundreds of patients to assess efficacy and identify any potential side effects.

Phase 3 clinical trials extend this sample of patients to the thousands, again monitoring for adverse reactions and assessing efficacy.

Batavia Biosciences has built a world-renowned R&D organisation that understands the challenges associated with biopharmaceutical product development

According to Batavia’s research, the attrition rate in the development of novel biopharmaceuticals is substantial, with only around five percent of candidate drugs successfully making it through the R&D phase into the first round of clinical trials.

Approximately 63 percent of these drugs then pass Phase 1 clinical trials, with only 31 percent of that number moving on to Phase 3. Less than 50 percent of novel biopharmaceuticals then advance to Phase 4 – also known as market introduction.

The R&D phase, therefore, has the highest attrition rate by far, with many putative products failing to progress into a regulatory-approved investigational new drug (IND) dossier – a prerequisite for conducting Phase 1 clinical trials.

Reasons for failure can include a lack of efficacy, poor biodistribution and adverse effects, among many others. In essence, an IND dossier must answer three pivotal questions: what scientific rationale is there for testing the candidate medicine on humans?

Has a process been established that allows for robust and reproducible manufacturing of the candidate medicine? And what safety data has been generated that allows a solid risk assessment of the candidate medicine to be tested on humans?

$127bn

Approximate spend on the development of new and improved biopharmaceuticals

As the development of highly complex biopharmaceuticals is extremely expensive (costing at least $100m to bring to market) and risky (given the high attrition rate), the commercial price of such medicines is typically very high.

Finding a remedy

It is in the R&D phase that Batavia and other contract development and manufacturing organisations (CDMOs) seek to offer their know-how and experience to improve market outcomes.

Batavia has a broad client base, comprising biotech companies, multinational biopharmaceuticals firms and non-profit organisations, including a range of academic, governmental and charitable institutions.

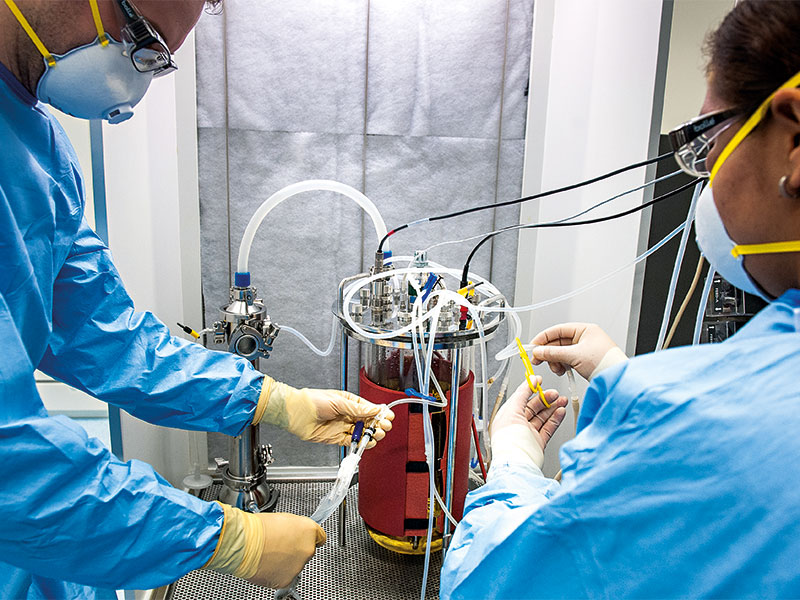

The company has state-of-the-art laboratory infrastructure in both the Netherlands and the US, and is well equipped to develop any biopharmaceutical – be it an antibody, recombinant protein or vaccine – from early discovery all the way through to clinical manufacturing.

Batavia collaborates with institutions such as the World Health Organisation, the Bill & Melinda Gates Foundation (BMGF) and the National Institute of Health, as well as a number of prominent academic institutes, to develop novel vaccines.

Examples of countermeasures currently under development include novel vaccines against respiratory syncytial virus, chikungunya virus and Ebola virus, as well as potent neutralising antibodies that protect against the Zika virus.

More recently, Batavia has been working with Univercells and Merck to create a low-cost manufacturing platform that will significantly ease the cost of global health vaccines.

$117bn

Amount dedicated to conducting clinical trials

The platform, which is known as OMNIVAX and is sponsored by the BMGF, aims to reduce the per-dose price of the trivalent poliovirus vaccine from around $2 to $0.15.

OMNIVAX brings together novel, high-cell-density-packed bed reactors, high-efficiency novel purification membranes and continuous processing to deliver lower costs through massive process intensification. The platform is also being rolled out around the world for a range of global health and epidemic-preparedness vaccines.

Culture of success

Batavia has built a world-renowned R&D organisation that understands the challenges associated with biopharmaceutical product development and can provide sponsors and collaborators with realistic and practical solutions.

As well as providing know-how, Batavia actively develops a range of tools and technologies to facilitate the development and manufacturing of biopharmaceuticals at reduced costs and accelerated timelines.

Examples of such technologies include the company’s SCOUT, SATIRN, SIDUS, STEP and SCOPE platforms, which help to provide a more thorough understanding of the manufacturing issues associated with novel compounds early in the product development chain. This gives companies the opportunity to either ‘fail fast’ or invest more capital into a prospective product.

$10bn

Amount dedicated to developing manufacturing processes

The market for CDMOs is expected to continue expanding, with some industry commentators even predicting year-on-year growth of up to 15 percent. A major driver of this optimism is the anticipated surge in the number of biotech companies operating around the world – due, in part, to exciting breakthroughs in fields like immuno-oncology and gene therapy.

It’s also important to note that multinational biopharmaceutical companies currently only contribute around 12 percent to the commercial outsourcing market. With this contribution expected to rise as companies look to outsource more of their commodity-based activities, it is likely we will see an increase in internal resource flexibility and a shift in focus towards activities that result in adding direct company value, such as intellectual property development.

Naturally, a continued demonstration of the value-added model that Batavia and other CDMOs present to their clients will further develop the outsourcing market for biopharmaceutical development and product manufacturing, making life-saving treatments cheaper for everyone.

Further information can be found at bataviabiosciences.com.