Pfizer leaps into biotech with Hospira purchase

Following the failed acquisition of AstraZeneca last year, Pfizer has unveiled plans to buy Hospira in a deal that will bring the company to the forefront of biotech medicine

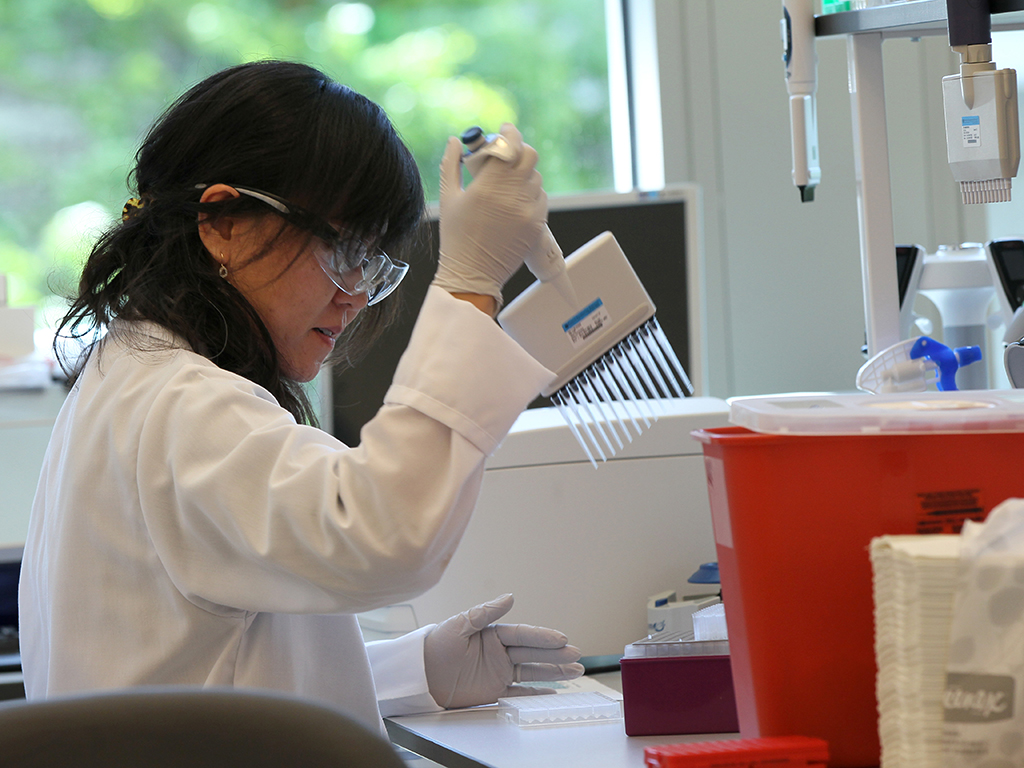

A scientists works in a Pfizer lab. The pharma giant has cemented its position in the biotech market with a purchase of Hospira

Pfizer has announced plans to purchase US-based Hospira for $15bn in order to bolster its standing in the growing market for biotech drugs, and specifically biosimilars.

Pfizer has lost approximately $26bn in global sales in a period of five years

Producing biotech medicine, which involves living cells, is a complex and expensive and process, thereby making mass production a pricey venture. In recent years, companies such as Hospira have begun creating replica drugs, known as biosimilars, in a bid to reduce the high costs of production.

Although various health organisations have shown trepidation about the use of biosimilars, which are similar, but not identical to proven treatments, an increasing number of health systems around the world are beginning to explore these products. According to a Thomson Reuters published report by Bioworld, total global sales for biosimilars is projected to reach $190bn by 2018.

By making this purchase, Pfizer gains access to Hospira’s European-sold biosimilar treatment for arthritis, a copy of the revolutionary drug Remicade made by Johnson & Johnson and Merck & Co. Hospira is also seeking FDA approval for this product; currently there are no biosimilars approved for use in the US.

“The Pfizer-Hospira combination is an excellent strategic fit. We hope it will fundamentally improve the growth trajectory of Pfizer’s Global Established Pharmaceutical business, vault it into a leadership position in the large and growing off-patent sterile injectables marketplace including enhanced manufacturing, and advance its goal to be among the world’s most preeminent biosimilars providers,” Pfizer told The New Economy today.

This acquisition comes at a crucial point for Pfizer as it contends with the loss of patent protection on various medicines. As a result, Pfizer has lost approximately $26bn in global sales in a period of five years, with a reported $3.5bn profit loss for the past year. The deal also comes as good news for Hospira, as Pfizer will assume their burdening debt of $17bn.