Apple shares recover as demand for iPhone grows

Tech giant beat low earning targets, causing shares to recover, writes Rita Lobo

Apple’s European sales have boosted share prices, after a difficult quarter. The tech giant has not updated its iPhone and iPad lines since last year, but has still managed to come on top in terms of analyst earning projections for the third quarter.

Apple shares have soared by nearly five percent after the company announced it had made a $6.9bn profit for the quarter ending in June, a feat it attributed to stronger than expected iPhone sales. According to the company, 31.2 million iPhones were sold in the period – a record – up from 26 million the same time last year. However, profit was down close to 22 percent year-on-year, with profit margins contracting from 42.8 percent to almost 37 percent. Though Apple has posted better than expected results, analysts have suggested that expectations were low compared to previous years.

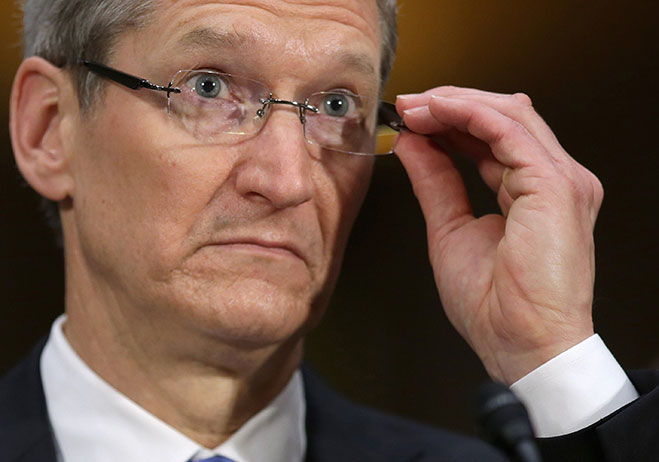

Apple is rumoured to be working on a number of new launches, expected to cause renewed interest in the brand and boost sales. “We are laser-focused and working hard on some amazing new products that we will introduce in the fall and across 2014,” Tim Cook, CEO of the company, has revealed.

“Basically because there are only so many iPads and iPods you can sell and buy, they are expensive items there is evidence that people are pulling back in demand because they are waiting for the next one,” explains Michael Hewson of CMC Markets. “People want to see a better new product with new features. They have been talking about iPhone 6, iWatch, and maybe an upgraded iPad with an improved camera, but there has been no indication of them being nowhere near that. Competitors are innovating and bringing out new products so Apple need to be seen to be innovating too.”

Sales of Apple products were down four percent during the second quarter. Research by IDC suggests that Apple ranks fifth in the region in terms of market share, far behind Samsung who dominate the market. The data also suggests that the average smartphone in China is likely to sell for under $200, significantly less than Apple’s high-end products, which further harms its business in the country. “That is a lower growth rate than we have been seeing,” Cook said. “I attribute it to many things, including the economy there.”

For Hewson, unless Apple can boost growth in China, it is unlikely they will be able to emulate previous successes. “They don’t have an agreement with a phone provider, though they are in talks with China Mobile. What they need is uplift in China. Its good in India and they need to achieve similar results in China.

“There is a lot of pessimism surrounding Apple’s performance, but it’s all about expectations; there are governments that would kill for that kind of revenue. But it’s a different market right now. Consumers are not consuming a lot. Markets are slowing down. But apple is still susceptible to same vagaries of consumer demand as other brands. We had a booming decade from 2002 2012, fuelled by credit and now we are paying off that debt. In Europe there is a saturated market. How many phones can a person buy? Unless they get significant exposure in Asia, particularly in China; unless they come up with a new killer product on the level of the iPhone and iPad when they first came out, the status quo is the best they can hope for.”