Samsung is getting over its Chinese burn

After its market share plunged in China, Samsung’s mobile chief says his company’s fortunes are about to turn around

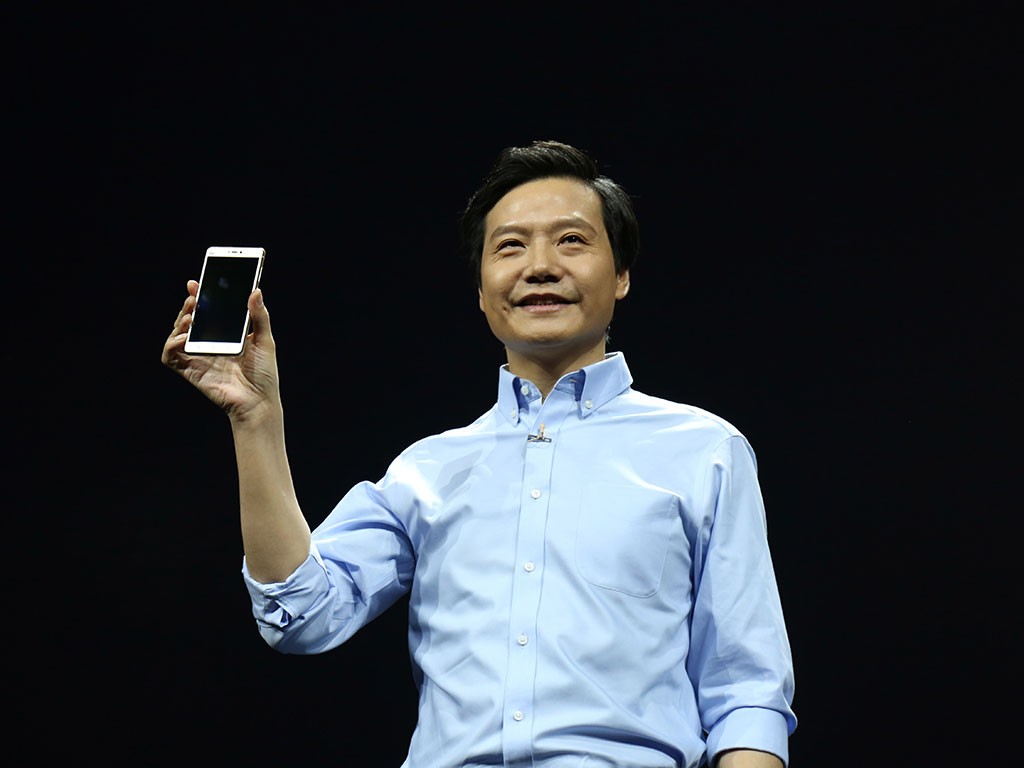

A woman waits for a lift outside a Samsung store in Beijing. The South Korean mobile phone firm has been squeezed in China by both higher-end iPhones and cheaper domestic brands

Speaking at the 2016 Mobile World Congress in Barcelona, Samsung’s mobile chief said the worst of the company’s troubles are over. DJ Koh said his firm’s position in the Chinese smartphone business had reached a stable point, and signs of growth would soon start to appear.

Samsung was once a dominant player in the Chinese smartphone market, but in recent years has faced tough competition. Challenges from both domestic and international companies have squeezed the South Korean firm’s market share.

Samsung’s market share in China was 7.7 percent in 2015, down from 20 percent in 2013

Samsung’s market share in China was 7.7 percent in 2015, down from 20 percent in 2013. As a result of the declining market share in China, the firm was forced to cut thousands of jobs in 2015.

The fall was partly due to rising prosperity and economic development in China: Western-produced smartphones, such as Apple’s iPhone, hold a greater prestige for newly rich Chinese consumers, while domestically-produced smartphones are both increasing in quality and lower in cost.

Speaking to World Finance in 2015, Konstantinos Venetis, an economist at Lombard Street Research, said: “Competition in important market segments has intensified, not least as Chinese players are gradually moving up the value chain. For example, lower-cost Chinese smartphone manufacturers have been making their presence felt largely at the expense of Samsung.”

Koh recognised the enduring threat posed by lower-cost Chinese producers, who are also likely to catch up with Samsung’s push towards making virtual reality mobile phone hardware in a few years. Samsung is, according to The Wall Street Journal, “looking for ways to build up an ecosystem where ordinary consumers could easily make their own content and use virtual reality to communicate with their friends”, in order to stand out from the competition.

The mobile chief also spoke of trying to change the corporate culture of the company, to foster more innovation and debate. He lamented the fact that “in Samsung, in the meeting room, if a senior executive says something, nobody argues”. He said he hoped to cultivate a new “Silicon Valley spirit” within the firm, whereby the higher rungs will more readily listen to the input of junior staff.