Dental implant firm thrives despite adverse economic conditions

Despite sluggish growth, increasing competition and dropping profitability, Straumann proves it is still possible to thrive in the dental industry by embracing innovation and smart strategies

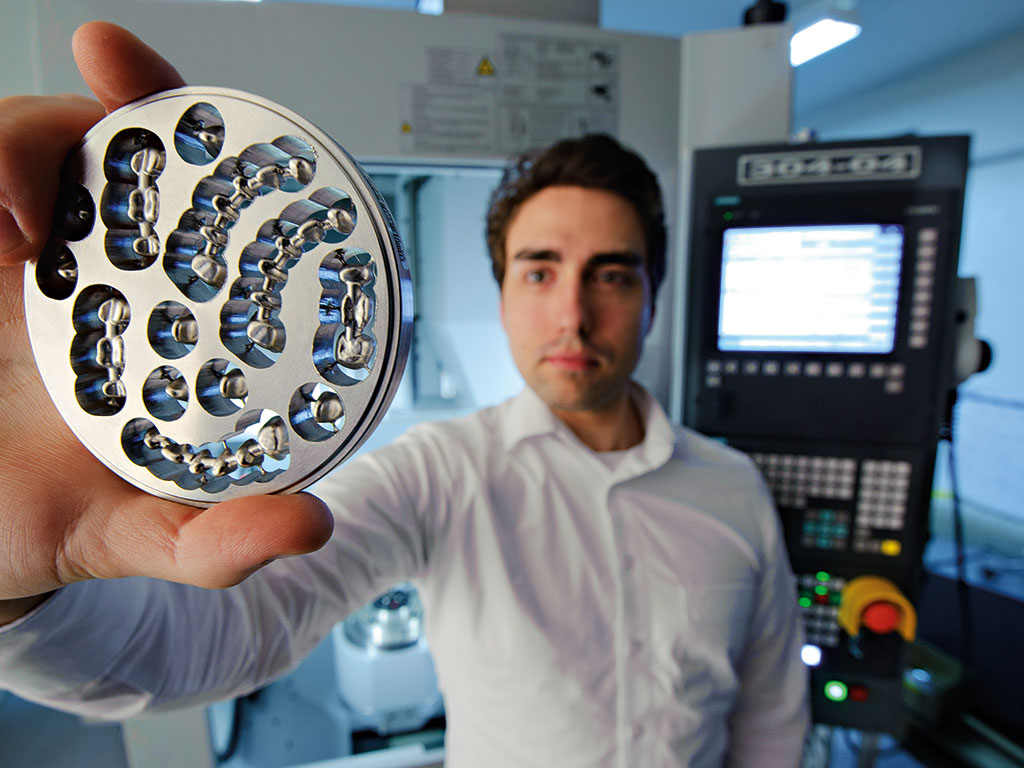

Modern prosthetic dental crowns and multi-tooth bridges are designed by computer and milled precisely from titanium or ceramic discs at Straumann’s CADCAM milling centres

Just three years ago the dental industry was still chewing its way through one of the toughest challenges it had ever faced. With austerity, high unemployment, reduced household income and low consumer sentiment, patients were reluctant to spend on out-of-pocket dental procedures – especially in Europe, the world’s largest market for implant dentistry. Like its peers, Straumann found itself facing sluggish growth, increasing competition from copycats, dropping profitability and slumping share prices.

Marco Gadola, who rejoined the company as CEO in 2013, has helped Straumann achieve a turnaround – through strict cost management and targeted investments to underpin its premium business, to penetrate the fast-growing value segment, and to unlock emerging markets.

The company has also introduced a range of biomaterials to create new bone, not forgetting its cutting-edge digital technology for dental labs and practices

A key priority has been to instil a new culture at Straumann that fosters high performance and innovation. In the past year, the group has brought a record number of new products and treatment solutions to market, ranging from less-invasive, fast-healing implants, to metal-free ceramic implants and complete solutions for total immediate tooth replacement. The company has also introduced a range of biomaterials to create new bone, not forgetting its cutting-edge digital technology for dental labs and practices.

Tapping into emerging markets

Straumann has not neglected Europe and has successfully defended its traditional markets there, having significantly reduced its costs without compromising on innovation, education and quality. It has also remained true to its Swiss roots despite the disadvantages of the exceptionally strong Swiss franc.

The group’s response to the macroeconomic situation has been to invest over-proportionately in underpenetrated and emerging growth markets outside Europe. For example, it has expanded its sales team in the US and has taken a new hybrid approach in China by switching from a single distributor to its own subsidiary and 20 sub-distributors to cover the geographical expanse. In Russia, it has taken over its distributor and established its own subsidiary, while in Latin America it is creating regional hubs to serve multiple countries.

Having traditionally focused on the premium segment, the group differentiates itself through quality, safety and patient wellbeing, which are reflected in more quality controls, a larger commitment to education, and higher investments in clinical research than its competitors – “simply doing more” is a core brand focus and an overriding principle in all the company does. In addition, it has defended its position against cheaper competitors by offering more value without price increases and by developing a new range of cost-effective prosthetics and other solutions that reduce overall treatment costs.

However, its main thrust into the value segment has been through investing in successful value players around the world to build a platform of mid-price brands. The recent acquisition of Neodent, the market leader in South America, was its largest investment to date and has lifted the group into the top five value players in the world. Almost without exception, companies in this segment are local but not international champions; making use of its global experience and network, Straumann has been able to drive the international expansion of the brands in which it has invested.

It has thus managed to position itself as an innovation leader in terms of pricing strategies and market tactics but also in developing products and solutions. The proof of this success is evident in the fact that every 10 seconds someone somewhere in the world is treated with a Straumann Group product.

The answer to consolidation

Consolidation is constantly redefining the industry landscape and Straumann’s main rivals have all been swallowed by dental conglomerates. The group has also been active in M&As and believes that agility and focus – which come through mindset and culture – as well as the ability to offer complete solutions for tooth replacement are the keys to sustainable success.

“The pace of change in our industry has accelerated, and in some countries dental implants are becoming mass products”, said Marco Gadola. “At the same time, the trend in innovation is shifting from groundbreaking technological breakthroughs to sales processes, holistic approaches and incremental improvements in products. For us, innovation goes beyond creating and developing new ideas to making them commercial successes, which means that our innovation process has to be customer- and market-driven.”

Set to pull away from the pack

Straumann’s culture is built on a long heritage of innovation and paradigm changes. Over the past 40 years, the company has done much to advance implant dentistry and has an impressive number of innovations to its name: for example, its new-generation Bone-Level Tapered Implant (which in less than a year brought the company more than 1,000 new customers and already accounts for more than 20 percent of the implants it sells) or its Roxolid implant material (which is significantly stronger than conventional titanium and enables the company to offer smaller, less invasive implants) and its SLActive surface that significantly reduces implant healing times. With such innovative new products, Straumann looks set to pull away from the pack in 2016.

All this has meant continued success for the firm against a backdrop of economic uncertainty. Straumann has outperformed its competitors for nine consecutive quarters in terms of revenue growth. Since 2012, its EBIT margin has improved from nine to 21 percent, and its share price has risen more than 150 percent. By focusing on its cultural journey and committing to innovation, Straumann is the clear market leader and the only top-tier company in the industry to remain independent.

Written in collaboration with Institut Straumann